In 2014, Cass Sunstein—one-time “regulatory czar” for the Obama administration—wrote an op-ed advocating for a cashless society, on the grounds that it would reduce street crime. His reasoning? A new study had found an apparent causal relationship between the implementation of the Electronic Benefit Transfer system for welfare benefits, and a drop in crime.

Under the new EBT system, welfare recipients could now use debit cards, rather than being forced to cash checks in their entirety—meaning there was less cash circulating in poor neighborhoods. And the less cash there was on the streets, the study’s authors concluded, the less crime there was.

Perhaps burglaries, larcenies, and assaults had gone down because there was simply less to readily steal. Perhaps, also, the debit cards deterred people from spending money on drugs and other black market goods. While nothing was really stopping them from withdrawing cash and then spending it illegally, the famous Sunsteinian Nudge was in effect—the very slightest friction in the environment pushed people away from committing crime.

The year after Sunstein’s op-ed was published, in a seemingly unrelated incident, a student at Columbia University was arrested and charged with five drug-related offenses, including possession with the intent to sell. Supposedly, his fellow students and customers had paid him through the Paypal-owned smartphone app Venmo.

Venmo makes every transaction public by default. The app features a social-network-like feed where you can see your friends sending each other varying sums of money, often accompanied with cute descriptions and emoji. The alleged dealer asked his customers to write a funny description for every transaction, and in doing so, turned his feed (and others’) into an open record of drug trafficking.

Nothing was really stopping the students from going to an ATM and withdrawing cash to use in the old-fashioned way. But that takes time and energy and meanwhile Venmo is sitting right in your pocket. The Ivy League’s best and brightest were Nudged into narcing on themselves.

In a cashless society, the cash has been converted into numbers, into signals, into electronic currents. In short: Information replaces cash.

Information is lightning-quick. It crosses cities, states, and national borders in the twinkle of an eye. It passes through many kinds of devices, flowing from phone to phone, and computer to computer, rather than being sealed away in those silent marble temples we used to call banks. Information never jangles uncomfortably in your pocket.

But wherever information gathers and flows, two predators follow closely behind it: censorship and surveillance. The case of digital money is no exception. Where money becomes a series of signals, it can be censored; where money becomes information, it will inform on you.

* * *

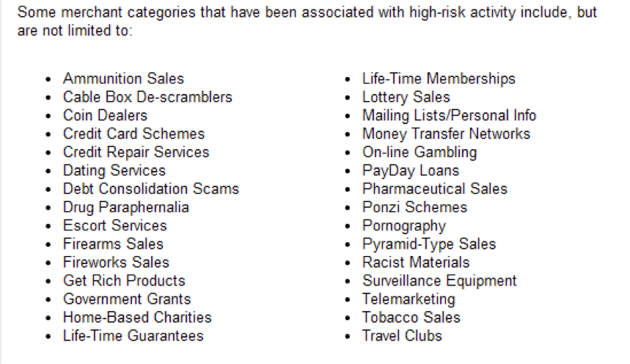

In the spring of 2014, the Department of Justice began to come under fire for Operation Choke Point, an initiative aimed at discouraging or shutting down exploitative payday lenders. The ends were, on the face of it, benign, but the means were highly dubious.The most vociferous objections to Operation Choke Point came from gun-rights activists, as the firearms and ammunitions industry were labeled “high-risk.” But guns were only one industry among a bizarre miscellany that had been targeted. Tobacco sales, telemarketing, pornography, escort services, dating services, online gambling, coin dealers, cable-box descramblers, and “racist materials” were all explicitly listed on the Federal Deposit Insurance Corporation (FDIC) website as “merchant categories that have been associated with high-risk activity.”

Critics of Operation Choke Point saw the initiative as a policing of vice, rather than a consumer protection campaign. Many of the targeted industries—like pornography—could be seen as morally unsavory. And in many cases—as with guns—such moral judgments were highly politicized. One pundit wrote, “[W]hile abortion clinics and environmental groups are probably safe under the Obama administration, if this sort of thing stands, they will be vulnerable to the same tactics if a different administration adopts this same thuggish approach toward the businesses that it dislikes.”

For many conservatives, Operation Choke Point was a new liberal offensive in the culture war, a backhanded attack on the Second Amendment. There was never any evidence that guns were the primary focus of Operation Choke Point, but the outrage continued, fueled by an alarming number of stories of firearms vendors being cut off by credit-card companies or suddenly having their bank accounts closed.

* * *

Eden Alexander fell ill in the spring of 2014. It started when she suffered a severe allergic reaction to a prescribed medication. Then by her account, when she sought medical attention, the care providers declined to treat her, assuming that the problem was illegal drug use.Alexander is a porn actress. According to her, she was profiled and discriminated against, and failed to receive due medical care. In the end, she developed a staph infection. She couldn’t work, and she struggled to take care of herself, let alone her medical bills, her apartment, her rent, her dogs.

Her friends and supporters—many of whom were also in the adult entertainment industry—started a crowdfunding campaign on the GiveForward platform, hoping to cover her medical expenses. She had raised over a thousand dollars when the campaign was shut down and the payments were frozen.

GiveForward said that her campaign had violated the terms of service of their payment processor, WePay: “WePay’s terms state that you will not accept payments or use the Service in connection with pornographic items.”

A few hours after Alexander received the notice via email, and posted about it on Twitter, she had to be taken to the hospital in an ambulance.

The initial reaction on social media was to assume that Alexander had, again, been discriminated against, and that the campaign had been shut down because of the stigma of her occupation. It turned out, however, that one of her supporters had offered to exchange nude pictures for donations to Alexander’s fund, on Twitter. (Of course, this only raises the question of how WePay had discovered the tweet, and whether they were in the habit of policing the Twitter conversations around all of the crowdfunding campaigns they were servicing.)

Of course, the abundance of forward-facing services and apps conceals the infrastructure that made Operation Choke Point possible in the first place. Transactions route through several tangled layers of vendors, processors, and banks. At various points in the chain, all transactions squeeze through bottlenecks created by big players like Visa, Mastercard, and Paypal: These are the choke points for which Operation Choke Point is named.

The choke points are private corporations that are not only subject to government regulation on the books, but have shown a disturbing willingness to bend to extralegal requests—whether it is enforcing financial blockades against the controversial whistleblowing organization WikiLeaks or the website Backpage, which hosts classified ads by sex workers, and allegedly ads from sex traffickers as well. A little bit of pressure, and the whole financial system closes off to the government’s latest pariah. Operation Choke Point exploited this tendency on a wide scale.

It’s probably fair to say that the federal government never targeted Eden Alexander, and that her hospitalization was not a foreseeable consequence of that bare list of bullet points put out by the FDIC—the list that threw “Pornography” next to “Debt Consolidation Scams” and “Get Rich Products.”

But subsequent statements made by WePay sketch out a cause-effect relationship between Operation Choke Point and the shutdown of Alexander’s crowdfunding campaigning, revealing how powerful the ripple effects of such initiatives could be. “WePay faces tremendous scrutiny from its partners & card networks around the enforcement of policy, especially when it comes to adult content,” a representative wrote in a blog post. “We must enforce these policies or we face hefty fines or the risk of shutdown for the many hundreds of thousands of merchants on our service. We’re incredibly sorry that these policies added to the difficulties that Eden is facing.”

(you can read the rest at)

http://www.theatlantic.com/technology/archive/2016/04/cashless-society/477411/

Mystery box on utility pole in Phoenix sparks questions

Questions remain regarding the origin of a mysterious box on a utility pole near 21st and Glendale avenues in Phoenix.

An SRP representative told ABC15 that no one had permission to put the box on their pole.

Clegg has video of what he described as an SRP crew removing the box late last month.

The box was facing Clegg’s house, a strip mall and a high school.

SRP said there were indications that law enforcement was connected to the box, but did not elaborate.

Clegg said the crew who installed the box came in a truck marked “Field Pros.”

A Google search of that name does not return any utility or surveillance company. Such a company is not registered in Arizona.

http://www.abc15.com/news/region-phoenix-metro/central-phoenix/phoenix-man-says-hes-being-watched-by-mysterious-box

Mystery solved! Box on Phoenix utility pole belongs to ATF

PHOENIX - The bureau of Alcohol, Tobacco and Firearms and Explosives came forward Thursday, admitting that a box spotted and removed from an SRP power pole on 21st and Glendale avenues belonged to them and was part of an ongoing investigation.

ATF officials would not elaborate on the investigation and would not say if they were conducting surveillance in the area.

Clegg was suspicious there could be cameras installed in the boxes but ATF would not confirm that.

"I feel that my privacy has been violated," said Clegg. "It's right behind my house."

There are homes, a high school, an apartment complex and a strip mall in the area. The strip mall has a salon, pet grooming store, alterations business, ammunition store and a barber shop.

"It makes me feel like they're up to something grimy," said Kevin Moreno who is a manager at the barber shop.

SRP tells ABC15 they had no idea the box was installed on their power pole. They said ATF has to notify them or work with them if they have an object on their property.

ATF tells ABC15 depending on the investigation and security they can put security measures in place without permission.

They say in this case they "acted within their bounds" but would not elaborate.

http://www.abc15.com/news/region-phoenix-metro/central-phoenix/mystery-solved-box-on-phoenix-utility-pole-belongs-to-atf

No comments:

Post a Comment